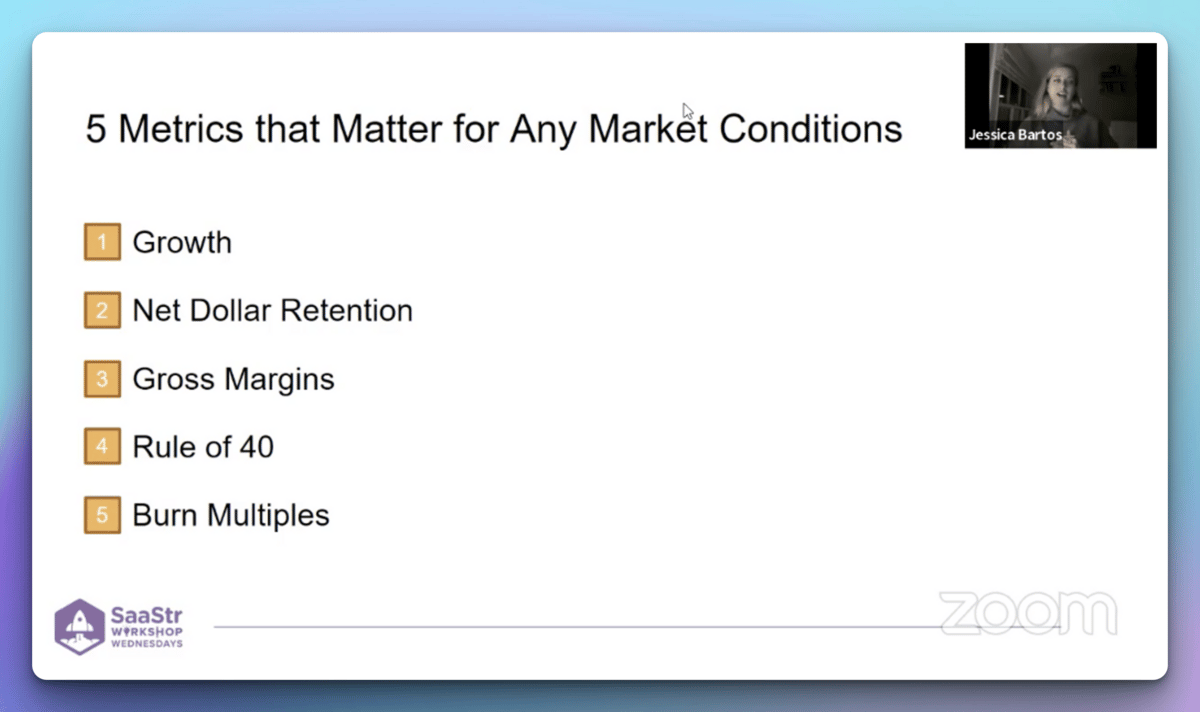

This week, SaaStr hosted a workshop with Jessica Bartos from Salesforce Ventures, covering the five metrics every SaaS company should care about. (I watched the 50-min video, so you don't have to.)

The five metrics SaaS companies should prioritize are:

Growth

Net Dollar Retention

Gross Margins

Rule of 40

Burn Multiple

⚡️ Given the current economic climate, it is not surprising that it can be difficult for many companies to raise capital. Jessica emphasized that if startups appear strong on these metrics, they can raise money and receive attractive valuations.

Growth

Raising money is about convincing investors that you will be the outlier vs. the rest of the market. One of the ways to do this is through growth metrics.

At the earliest stages, Investors like to see companies that can go from launch to $1m in ARR in 12 months or less.

Afterward, investors aim for what is referred to as "T2D3", meaning growth tripling for 2 years, then doubling for another 3 years.

Many believe that growth will eventually stagnate. However, data suggests that sustained growth is possible; typically, companies can maintain 80% of the growth from the previous year. Jessica insists that software markets are usually larger than investment analysts tend to anticipate.

In summary, the key is for founders to show strong momentum.

Net Dollar Retention

Net Dollar Retention (NDR) measures your Annual Recurring Revenue (ARR) growth or decline over time. It takes into account customer expansion, as well as negative churn and downgrades.

To calculate Net Dollar Retention, you:

Take your beginning ARR

Add (+) any upsells or cross-sells (i.e., expansion)

subtract (-) churn

Divide (÷) this total by your beginning ARR

NDR is computed as a percentage (%).

A good NDR is any figure above 100% and indicates a company's capacity to generate revenue from existing customers. This is significant because selling to existing customers will always be more cost-effective than acquiring new ones.

When an NDR is below 100%, companies need to work harder to acquire new customers to maintain or increase their revenue.

More companies are experimenting with new pricing models to boost their NDR, such as usage-based (consumption/usage drives revenue). Relying solely on "per seat" pricing has drawbacks, as when companies downsize and remove seats, the revenue will decrease.

Gross Margin

The beauty of software lies in its asset-light nature; it doesn't require much (infrastructure or inputs) to deliver your product or service to the client.

This translates to a very low cost of goods sold (COGS), creating high gross margins (70-80%).

Investors love this metric as it reveals which companies are genuinely SaaS-based, as opposed to those requiring significant input and manual intervention.

Rule of 40

The Rule of 40 states that a software company's combined revenue growth rate and profit margin should be equal to or exceed 40%.

To compute the Rule of 40:

Take your ARR growth rate or Revenue growth rate.

Add (+) your EBITDA margin or Free Cash Flow (FCF) margin.

Companies with a score above 40% indicate that they can generate a sustainable level of profit. In comparison, those below 40% are not as efficient and may be experiencing cash flow or liquidity problems.

This metric is vital because, without cash available to reinvest, growth is not possible.

Burn Multiple

An excellent way for VCs to look at efficiency within a company and see how it correlates to growth

Enters the burn multiple = cash burn divided (÷) by net ARR.

This metric captures cash flow issues within a company, such as low gross margins, poor sales efficiency, and high R&D expenses.

For early-stage companies, this number is usually high since ARR is low. However, as ARR grows, companies should aim to get this number under 2, then 1.5, and eventually below 1.

This metric is beneficial for distinguishing companies that have a lot of hype and raise a lot of money but don't generate much ARR.

Takeaways

If you can gain anything from this presentation, it is that fundamentals remain essential. Fundamentals are timeless and consistently effective.

Digital transformation is here to stay, and software is not going anywhere. This means more companies will continue to emerge, and those who excel in the five metrics above will be more attractive to investors.

Last but not least, your ability to generate cash flow is of utmost importance. Focus on financial results, not hype.