Happy Sunday, crew!

This week's newsletter covers a recent report by EY showing how Indian B2B SaaS companies are 2x more capital efficient than their global peers.

We will explore the reasons behind this phenomenon, as well as the growth strategies that are enabling Indian SaaS companies to thrive.

Let’s go!

-Alejandro

🍿 Quick Snack

🤑 Indian B2B SaaS companies are 2x more capital efficient than global peers, according to a recent report by EY

🇮🇳 Nexus Venture Partners and Grayscale Ventures raise large funds to invest in Indian SaaS startups

💼 Meta and ByteDance, the parent companies of Facebook and TikTok, respectively, plan to cut jobs, restructure, and change leadership amidst economic instability and competition

💸 +8 Funding Rounds

🍔 The Full Meal

Indian B2B SaaS companies 2x more capital efficient than global peers

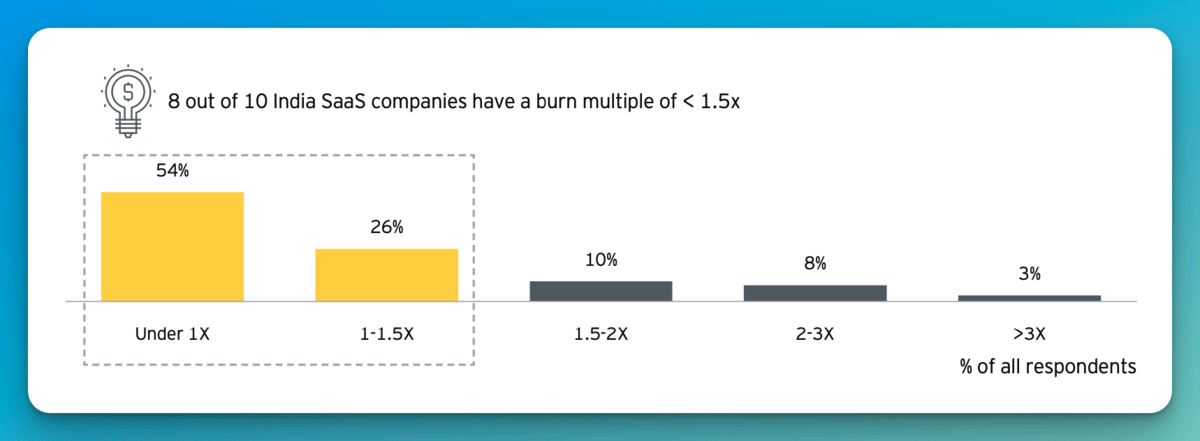

A recent report by EY reveals that Indian B2B SaaS companies are 2x more capital efficient than their global peers, with 8 out of 10 Indian SaaS companies having a burn multiple of under 1.5x.

This can be attributed to lower labor costs and a talent pool that is trained in remote customer engagement, inside sales, and customer support, which can lead to higher capital efficiency leverage.

According to EY's research on the top 30 global large public B2B SaaS companies (with over $0.5b ARR), those that are capital-efficient experienced the least value erosion in the past year, during which enterprise valuations plummeted. This suggests that only companies that can operate efficiently with capital will be able to survive and thrive.

The report proposes that the inherent capital efficiency of India's SaaS means that the next generation of long-lasting SaaS companies, such as Salesforce, Veeva, Atlassian, and ZoomInfo, will inevitably emerge from India.

But what makes these companies so different? Let’s look at some of their findings:

Finding #1: Indian SaaS growth is capital efficient by default (burn multiple < 1.5x)

Globally, a burn multiple under 2x is considered ‘good’, while 80% of Indian B2B SaaS companies have a burn multiple under 1.5x, which is considered ‘great.

Indian SaaS companies have also shown to be capable of retaining high levels of capital efficiency even at growth stages. 8 out of 10 companies surveyed with ARR > US$10 million have a burn multiple of under 1.5x.

The report proposes that a different approach to growth is what is helping Indian companies distinguish themselves from their U.S. counterparts. U.S. companies typically prioritize scaling through partnerships and sales and marketing spending.

In contrast, Indian companies focus on niche opportunities, often targeting SMEs, and concentrate on implementing pricing structures and modularity within their product offerings.

Finding #2: Indian SaaS companies are bullish on growth for 2023, despite weakening macroeconomic trends

This optimistic outlook appears to be rooted in their chosen growth strategies and the nature of the markets in which they operate. Indian Saas companies are focused on:

Capitalizing on small and mid-sized markets by differentiating through niche and cost-effective products.

E2E Multi-product strategy: Launching suite of products through quick iterations to drive growth within the same industry segment and capture the entire value chain (end-to-end).

Building domain expertise in one vertical first, build differentiated offering(s) in it, and then scaling the offering to multiple customers within the same industry segment

The majority of companies targeting ultra-growth are from Artificial Intelligence (AI), Human Capital Management (HCM), Fintech, Customer Relationship Management (CRM), and Customer Data Platform (CDP) segments.

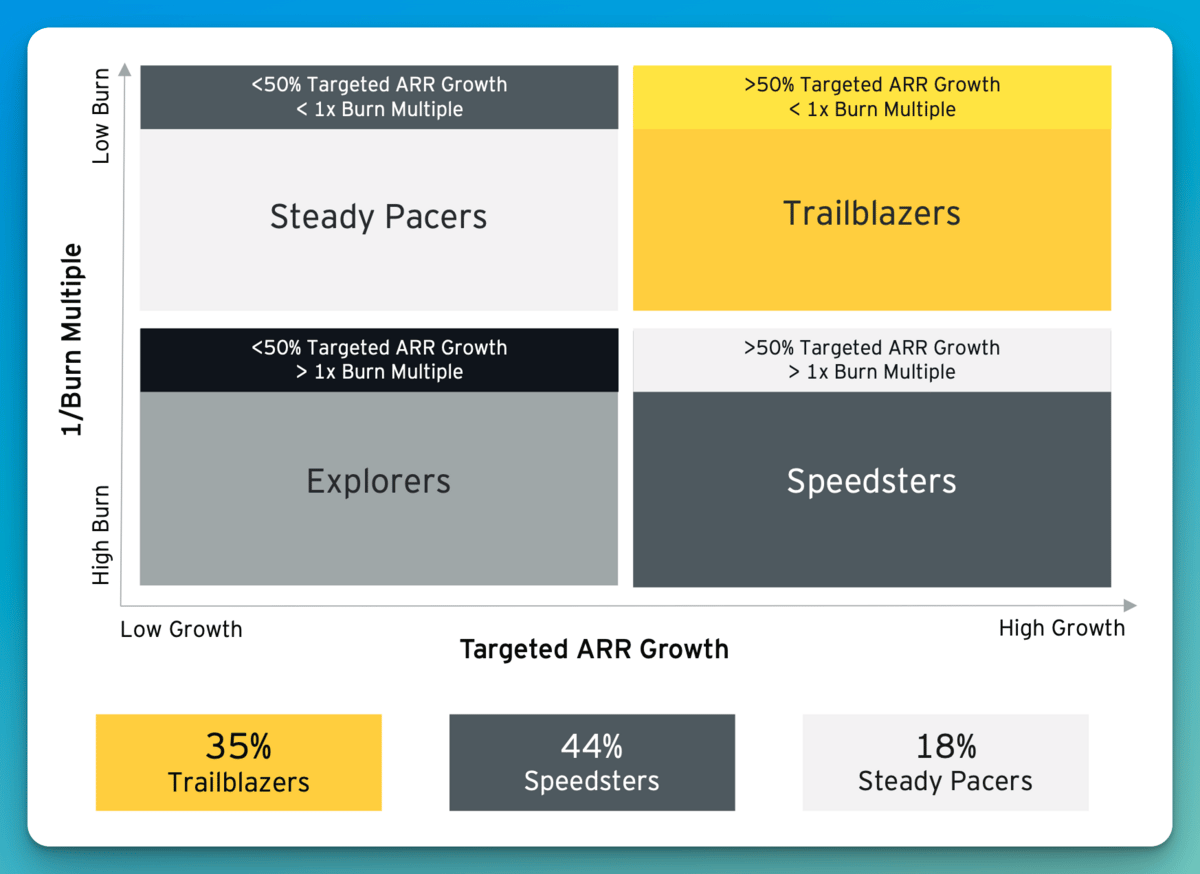

Finding #3: 1 out of 3 Indian SaaS are Trailblazers (ultra or hyper-growth companies with very low burn multiples)

Trailblazers seem to possess four attributes that set them apart from the rest of the pack:

Attribute #1: Financial discipline and constraints

90% of bootstrapped companies are trailblazers and steady pacers

85% of funded companies are trailblazers and speedsters

Attribute #2: Domain Expertise is key to growth

90% are vertical SaaS companies are trailblazers and speedsters

45% of horizontal SaaS are speedsters

Attribute #3: Trailblazers maintain capital efficiency even at growth stage and beyond.

27% of >US$5m ARR companies are trailblazers

45% of >US$5m ARR companies are speedster

27% of >US$5m ARR companies are Steady pacers

Attribute #4: Location. Location. Location.

83% of the India HQ companies are trailblazers and speedsters

Only 42% of US HQ companies are speedsters

But what what exactly are trailblazers doing different?

According to the report, Trailblazers prioritize product innovation to take advantage of niche market opportunities. Additionally, they rely on low-cost customer acquisition processes.

They focus on product innovation and technology leadership. This implies two things:

Build differentiated products that focus on simplicity, ease of use, and self-service

Focus on ease of deployment and usability to increase product adoption

They focus on a customer-focused buying experience. To achieve this, companies:

create a modular product with buyer-focused features and pricing to facilitate opt-in.

create micro-use cases to become more relevant to the buyer persona.

They focus on low-cost customer acquisition through content marketing, word-of-mouth referrals, and even collaboration (rather than competition) with full stack providers.

On the other hand, speedsters tend to focus on sales leadership strategies and build partner-led expansion strategies to scale enterprise accounts and optimize sales and marketing operations.

They build enterprise-focused sales expertise, meaning:

Hiring seasoned sales leaders and aim to increase ARPA (average revenue per account) and ACV (annual contract value)

Hosting stakeholder engagement events and nurturing the ecosystem

They leverage partnerships to grow. Mainly, they prioritize:

Investment in long-term alliances and partnerships with large enterprises

Creating reseller networks across various industries and geographies

Partnering with hyper scalers, such as AWS, Microsoft Azure, and Google Cloudmarketplaces

⚡️ Power Take:

Globally, smaller companies that have demonstrated a path to profitability will be able to raise capital on favorable terms and/or become attractive acquisition targets.

Larger companies with high-capital efficiency will be in a position to become acquirers themselves, allowing them to consolidate their market position and expand their product offerings.

Nexus Venture Partners Raises Largest Fund Yet to Invest in AI and Software Revolution

Nexus Ventures Partners has raised a $700 million fund, its seventh, to invest in startups across AI, SaaS, fintech, and commerce in India and the US.

The pandemic has accelerated digital adoption worldwide across enterprises and consumers, and remote workforces have enabled startups to flourish.

With one of the largest developer bases in the world, India is emerging as a key innovation and talent hub for global companies driving AI and software revolution.

"India is also amongst the fastest-growing economies on the planet, with accelerating digital consumption powered by best-in-class mobile data networks and advanced payments infrastructure”

Nexus Venture Partners has invested in unicorns such as Zomato, Delhivery, Unacademy, along with Zepto and Rapido.

The $700m fund is the second-largest fund raised by an Indian VC firm. Sequoia Capital India is the largest fund, raising $2.85 billion to invest in India and Southeast Asian startups in mid-2022.

Grayscale Ventures raises $10M for debut fund focused on Indian SaaS startups

Grayscale Ventures has raised half of its $20 million target for its debut fund.

The Singapore-based fund will invest in 15-20 startups in the pre-seed stage, with a focus on Indian SaaS companies.

India is well on its way to take over the United States in terms of a large developer base, and the firm is betting on the emergence of developer-focused firms like Hasura and TestSigma from India.

The firm expects the next generation of SaaS companies to be build for specific industries (Vertical SaaS) and based on AI capabilities.

Investment Stage: Grayscale Ventures usually invests in startups that have a product or service ready in some form, before the product-market fit stage. Only in very rare occasions it will consider pre product-stage companies.

Investment Term: Grayscale Ventures expects to stay with a company for 10-12 years until it becomes very large or goes for an IPO.

Meta Flattens Hierarchy, Pushes Leaders into Lower-Level Roles

Meta, the parent company of Facebook, is planning a new round of job cuts, which will affect thousands of workers.

The company plans to flatten its hierarchy by pushing some leaders into lower-level roles without direct reports. It is asking many of them to transition to individual contributor jobs or leave the company.

Meta is also reshuffling its top leaders, and Meta's Chief Business Officer, Marne Levine, recently announced that she was leaving the company after 13 years.

Meta’s business, which relies on advertising, has been hit particularly hard by a steady stream of economic challenges, such as the inflation that continues to create market instability.

Meta is also increasingly fending off competition for marketing dollars and users from upstart social media rivals, such as TikTok.

ByteDance, TikTok's Parent Company, Set to Lay Off Thousands of Workers in China

ByteDance, the owner of TikTok, plans to lay off over 10,000 employees in China due to an economic slowdown, dwindling growth, and unviable projects.

ByteDance continues to face political pressure in the United States and other key Western markets due to security worries over TikTok.

Canadian privacy commissioners are investigating TikTok's data practices, with a focus on how they affect younger users. This follows class action lawsuits and media reports about TikTok's collection, use, and disclosure of personal information.

Disputes in the US have also led to TikTok being banned by over 20 states in the US, as well as device and network-wide bans in several universities.

Chew Shou Zi, the chief executive of TikTok, is expected to give testimony in the US Congress about the app's operations in late March.

🍟 Extra Fries

Don't look at me. The Biden administration plans to release a new national cybersecurity strategy to hold software manufacturers and device makers accountable for cybersecurity breaches. The strategy seeks to shift the responsibility for hacks from hacked companies to manufacturers of software and devices. (Read More)

The SaaS won't stop. Big Band Software has launched as a B2B SaaS software holding company focusing on acquiring smaller businesses with high customer retention, profitable growth, and revenue from one to ten million. The company aims to deploy up to $100 million to create value-driven options for growth-minded organizations. (Read More)

Sign me up. Bengaluru-based SaaS community, SaaS Insider, plans to launch an app in June to help SaaS founders and investors connect and secure deals. The app will offer discussion threads, job postings, and mentorship, and aims to connect Indian SaaS startups with international VC firms interested in investing in the local market. (Read More)

💸 Funding Rounds

Temporal | $75m Series B: build and operate resilient applications using developer-friendly primitives (link)

Typeface | $65m Series A: generative AI application for creating enterprise content (link)

SpotDraft | $26m Series A: AI-powered Contract Lifecycle Management solution for high-growth startups (link)

Attio | $23.5m Series A: powerful, flexible and data-driven CRM ****(link)

Bonusly | 18.9m Series B: online platform for employee recognition, rewards, and engagement (link)

Plum | $6m: objective data to measure and match human potential to job needs, enhancing talent decisions across the employee lifecycle (link)

Polyteia | $5.3m Late Seed: actionable data for decision-making for governments (link)

Crstl | $4.4m Seed: no-code Electronic Data Interchange (EDI) for modern brands, manufacturers, and wholesalers (link)

💬 If you have any feedback or suggestions for future topics, please don’t hesitate to reach out. Follow me on Twitter to stay in touch.